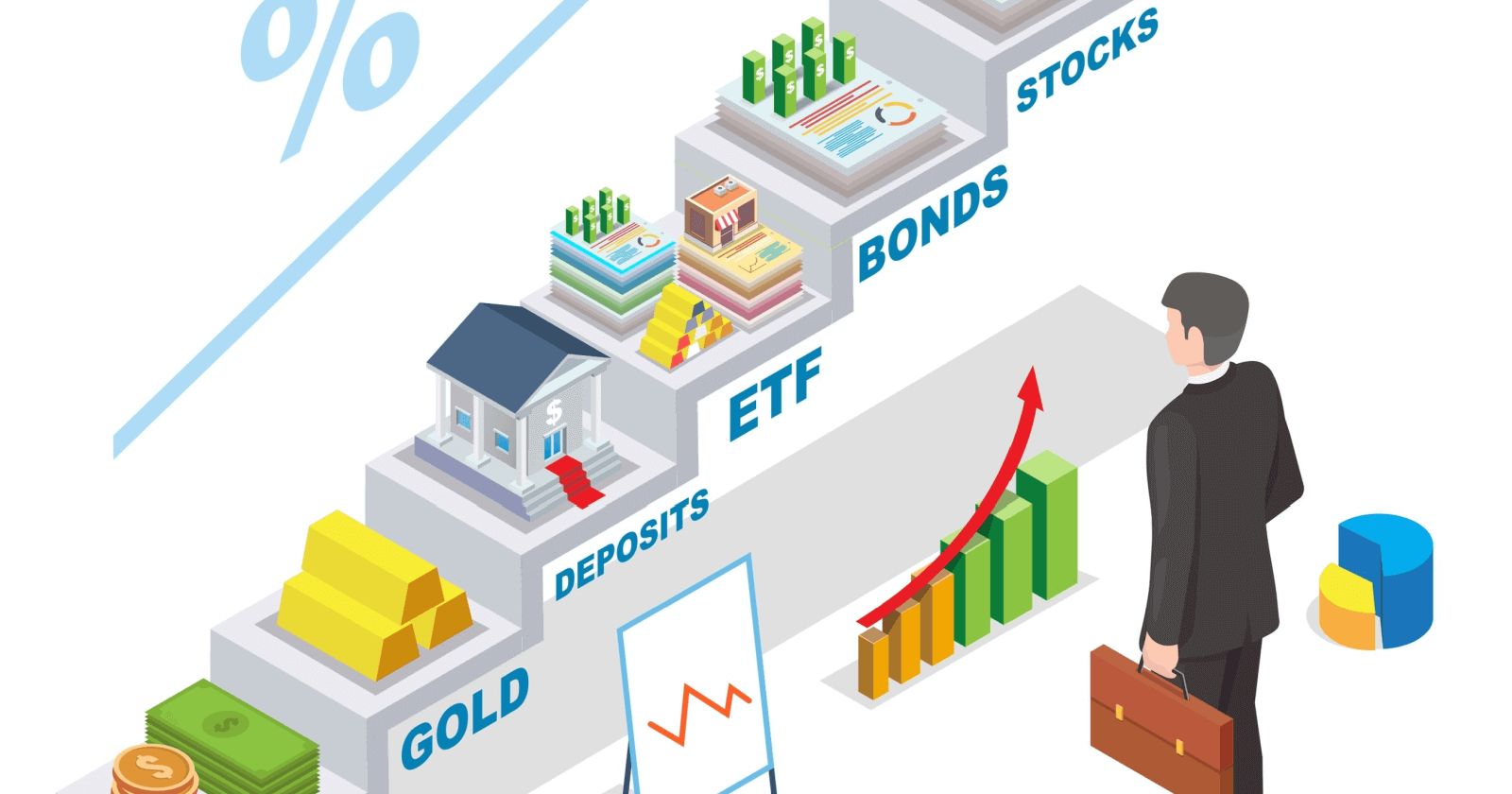

Top Investment Options

Investing is one of the most reliable ways to build long-term wealth and financial independence. From traditional assets like gold and bonds to modern vehicles such as ETFs and cryptocurrencies, each option offers unique benefits and risks. Below is a complete breakdown of the most common investment types, their pros and cons, and how they fit into a diversified portfolio.

1. Real Estate – Building Wealth Through Property

Real estate investing — the practice of buying property to generate income — is one of the oldest and most proven ways to build long-term wealth. Unlike stocks or bonds, real estate is a tangible asset you can see and touch. It provides two key sources of profit: rental income, which creates steady cash flow, and appreciation, which increases your net worth as property values rise over time.

Real estate is popular because it offers unique advantages that many other assets do not. It allows investors to earn consistent income through rent while benefiting from potential long-term appreciation. Thanks to leverage—using borrowed money to acquire assets—you can control large properties with a relatively small initial investment. Moreover, real estate acts as a natural hedge against inflation, since both property values and rental prices tend to rise with the cost of living.

There are two main approaches to property investing. The first is direct ownership, where investors buy and manage physical assets such as homes or commercial buildings. This strategy provides full control but also involves significant management responsibility. The second is through Real Estate Investment Trusts (REITs), which allow you to invest passively by purchasing shares in companies that own and operate income-producing properties. REITs trade on major exchanges, offering liquidity and easier access to the real estate market without large upfront costs.

However, real estate is not without risk. Properties can be illiquid and expensive to maintain, with potential issues like vacancies, market downturns, and costly repairs. Because many investors allocate a large share of their wealth to a single property, concentration risk is also a factor. Still, when managed wisely, real estate can serve as a strategic foundation for long-term financial growth, combining income stability, capital appreciation, and tangible value in one powerful asset class. Discover how to navigate the complex world of real estate investing with this comprehensive guide to property investment strategies. Read more about Real Estate investing

2. Crypto – The Digital Frontier of Investing

Cryptocurrency has revolutionized the financial landscape by introducing decentralized digital assets like Bitcoin and Ethereum. While highly volatile, crypto offers massive growth potential for those who understand its market dynamics. It’s driven by blockchain technology, which ensures transparency and immutability. Discover essential strategies and build a robust crypto portfolio with our expert guide. Read more about Crypto Investing.

3. Gold – The Classic Safe Haven

Gold has stood the test of time as a universal store of value. Investors turn to it during economic uncertainty or inflationary periods because its value often rises when other markets struggle. Whether you prefer physical gold (bars and coins) or modern financial instruments like gold ETFs, this asset class remains a cornerstone of portfolio stability. To better understand its role and modern investment methods, you can learn more about investing in gold and how it acts as a hedge against inflation.

4. Bank Deposits – The Reliable Low-Risk Choice

Deposits, such as savings and fixed-term accounts, are ideal for individuals seeking safety and guaranteed returns. While they don’t generate high profits, they provide security and liquidity, making them a good fit for emergency funds or short-term goals. If you want to explore how interest rates and deposit terms affect your earnings, learn more about bank deposits and discover how to maximize safe returns.

5. ETFs – Simple, Diversified, and Accessible

Exchange-Traded Funds (ETFs) have become one of the most popular investment tools among both beginners and professionals. They combine the diversification benefits of mutual funds with the flexibility of stock trading. ETFs can track indices, commodities, or sectors, giving you broad exposure with minimal effort. You can learn more about ETFs and how they allow investors to own fractions of hundreds of companies through a single trade.

6. Bonds – Predictable Returns and Stability

Bonds are fixed-income instruments issued by governments or corporations to raise capital. They provide steady interest payments, making them an excellent choice for conservative investors. Government bonds are generally considered safer, while corporate bonds may offer higher returns in exchange for slightly more risk. To understand the different types, yields, and durations, learn more about bonds and how they can provide consistent income within a balanced portfolio.

7. Stocks – Ownership and Long-Term Growth

Stocks represent ownership in a company and offer the potential for significant growth over time. Although stock prices can be volatile, they have historically delivered some of the best long-term returns. Investors can also earn dividends – periodic payments distributed from company profits. If you’re interested in capital appreciation and wealth building, learn more about investing in stocks and how to choose shares that align with your risk tolerance and goals.

Building a Balanced Investment Strategy

A strong investment portfolio blends security with growth. Conservative investors might prioritize deposits, bonds, and gold, while risk-tolerant investors could lean toward stocks, ETFs, and crypto for higher potential returns. The key is diversification – spreading your capital across multiple asset types to reduce risk while optimizing returns.

Share on